The Federal Housing Administration of America have set insured loans commonly known as the FHA loan. This kind of mortgage is dedicated for those with income unable to cover large down payment.

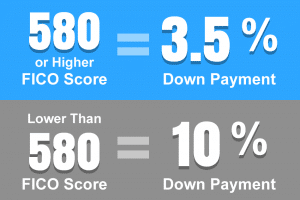

The FHA Loan is widely known, especially for first time home buyers, as this can allow anyone with a credit score above 580 to potentially claim a down payment of 3.5%. A 10% down payment can equal to a credit score of 500-579.

But as of 2017, up to 96.5% of the value of the home can be of loan. The 3.5% down payment requirement can possibly be a gift or grant.

Lack of credit score is also not a problem with the Federal Housing Administration. In fact, the FHA Loan even extends to those without any credit history. The FHA Lender will look into the history of your other mode of payment (like utilities and previous rent) records to which will serve as your score.

Regardless if the borrower have gone through bankruptcy or foreclosure, they may still qualify for a loan. Just remember: the lower the credit score, the higher the interest rate and so otherwise.

FHA borrowers include mortgage insurance. To which protects the lender from any loss in chances that the borrower defaults from the loan.

FHA Loan’s Credit History and Score Requirements

From the FHA Organization themselves, the benefits of the FHA loan are as follows:

- Easier to Qualify

While most loans exclude applicants with questionable credit history and low credit scores, the FHA makes loans available with lower requirements so its easier for you to qualify.

- Competitive Interest Rates

You’ve heard the horror stories of subprime borrowers who couldn’t keep up with their mortgage interest rates. Well, FHA loans usually offer lower interest rates to help homeowners afford housing payments.

- Lower Fees

In addition to lower interest rates, you can also enjoy lower costs on other fees like closing costs, mortgage insurance and others.

- Bankruptcy / Foreclosure

Just because you’ve filed for bankruptcy or suffered a foreclosure in the past few years doesn’t mean you’re excluded from qualifying for an FHA loan. As long as you meet other requirements that satisfy the FHA, such as re-establishment of good credit, solid payment history, etc., you can still qualify.

- No Credit

The FHA usually requires two lines of credit for qualifying applicants. If you don’t have a sufficient credit history, you can try to qualify through a substitute form.

As how the FHA puts it: Good Credit History Makes it Easier to Qualify.

If you’re in search of a mortgage accredited by the FHA, look no further!

BuyLikeRent is approved by the FHA standards and would be more than happy to be of help in achieving your dream home!

Buy Like Rent is a Real Estate Agency based in Florida with an experience for over 50 years in rent-to-own, buy and sell, property investment, real estate brokerage, and mortgage banking operation services.

Buy Like Rent is your dedicated Real Estate broker with over 50 years of experience in selling residential real estate, buylikerent homes, and property investments.